As featured in Chrisman Commentary, Daily Mortgage News

By Tela Mathias, Chief Nerd and Mad Scientist

Generative artificial intelligence (genAI) did not arrive quietly in the mortgage industry. It burst onto the scene with accelerated timelines and forced uncomfortable questions about relevance, speed, and survival. For many leaders, AI remains a buzzword or a vague mandate handed down from the boardroom. For others, it has become an existential inflection point. The difference between those two perspectives is not technology. It is mindset and this gut-based belief that radical change is upon us.

In late 2023, as generative AI tools matured rapidly, the realization set in that traditional approaches to work were no longer necessary. Tasks that once required armies of analysts, spreadsheets stitched together by hand, and months of effort could suddenly be decomposed, analyzed, and rebuilt in days. In mortgage servicing alone, years of regulatory guides, handbooks, and policy documents had historically demanded painstaking manual effort. Generative AI offered a fundamentally different path forward.

That moment forced a decision that many technology-driven businesses now face: wait for the market to define the future, or actively shape it. The metaphor often used is simple but stark. You can eat the bear, or the bear can eat you. In an industry built on legacy systems, regulatory pressure, and deep technical debt, standing still is no longer a neutral choice.

Being an AI builder today is not about chasing every new tool or trend. It is about living at the intersection of stability and experimentation. On one side sits the established generative AI stack, the techniques and architectures that are already reliable enough for production use. On the other side is the bleeding edge, where tools change weekly and experimentation is constant.

For those deeply embedded in this work, the day often starts early, or at least mine does. The quiet hours of the morning provide space for creative thinking, learning, and trial and error. This is where new models are tested, workflows are prototyped, and failures are reframed as data points rather than mistakes. It is also where a crucial mindset takes hold: the beginner’s mindset.

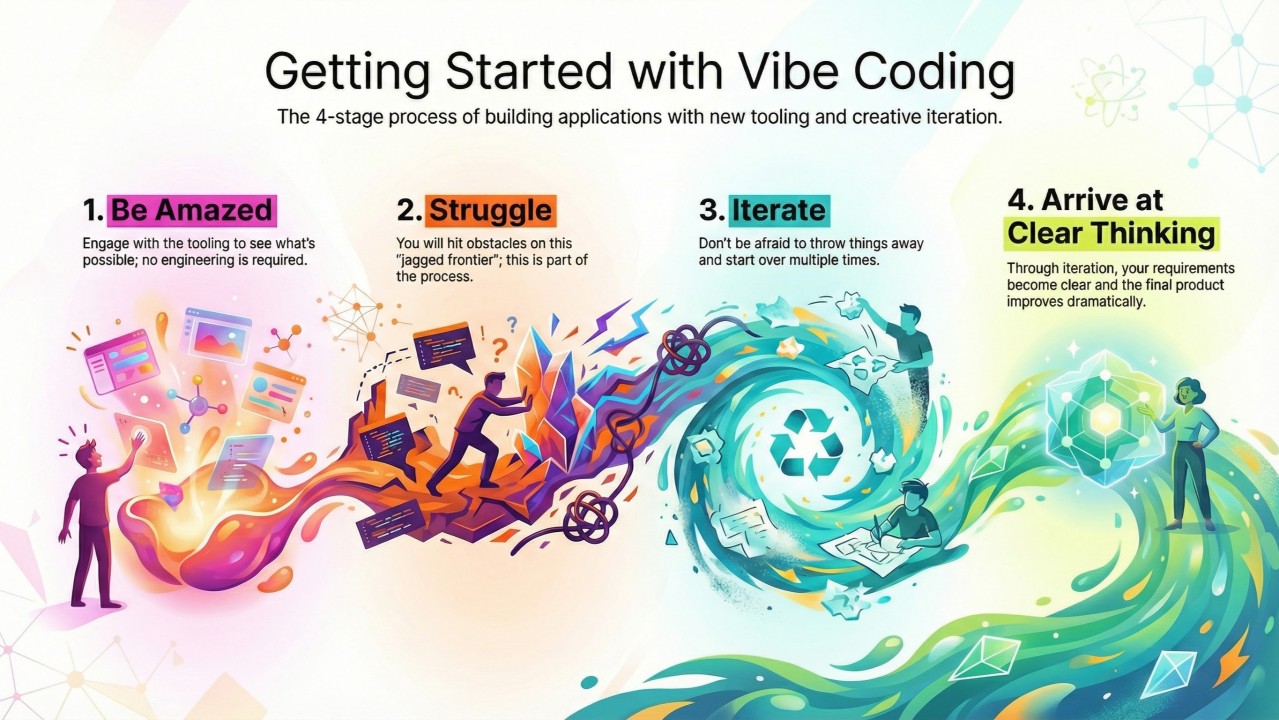

The beginner’s mindset is essential because generative AI does not reward rigid thinking. It rewards curiosity, play, and iteration. Much like a child approaching art without fear of mistakes, effective AI builders treat failures as “happy accidents,” learning what does not work in order to uncover what might.

One of the most profound shifts generative AI introduces is scale. AI does not replace talent; it amplifies it. It takes natural ability and multiplies it by removing friction, repetitive work, and manual constraints. For the first time, individuals can move from concept to deployed prototype in hours rather than months. In our lifetime, entire products will be imagined, built, tested, and deployed securely at scale by a single person in a weekend.

This is why AI feels almost disorienting at first. Long-standing barriers between idea and execution have collapsed. What once was only possible through a carefully coordinated “process” now simply requires clarity of thought and the ability to communicate a goal in natural language. English, not code, is the fastest-growing programming language in the world.

Yet this power comes with a caveat. AI amplifies humanity. It does not possess judgment, innovate, or aspire. Those remain uniquely human characteristics, especially in an industry like mortgage lending, where decisions affect people’s lives and financial futures.

For a novice, generative AI is not much more than a research assistant. For those with creative mastery, it’s an exponential force multiplier.

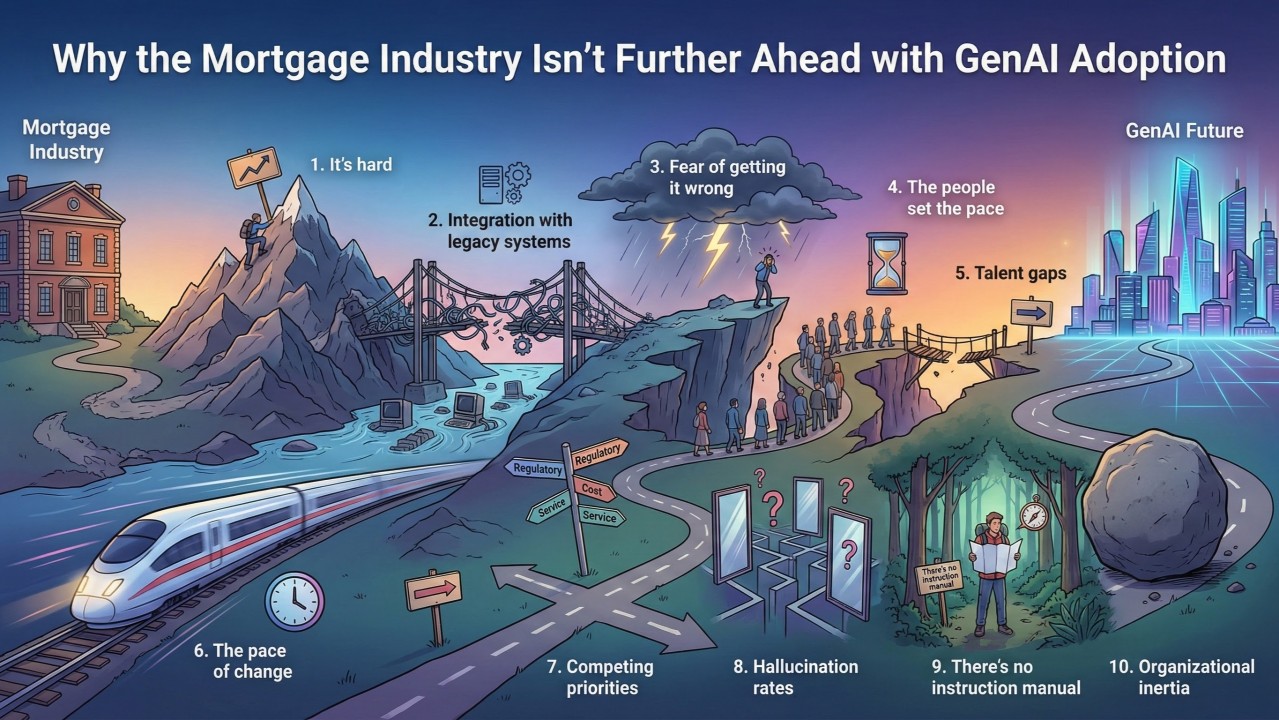

Despite the promise of “anything you can imagine, you can build,” AI still operates along what researchers call the jagged frontier. Some complex tasks are suddenly trivial, while others remain stubbornly out of reach. Nowhere is this more apparent than in regulated industries like mortgage lending.

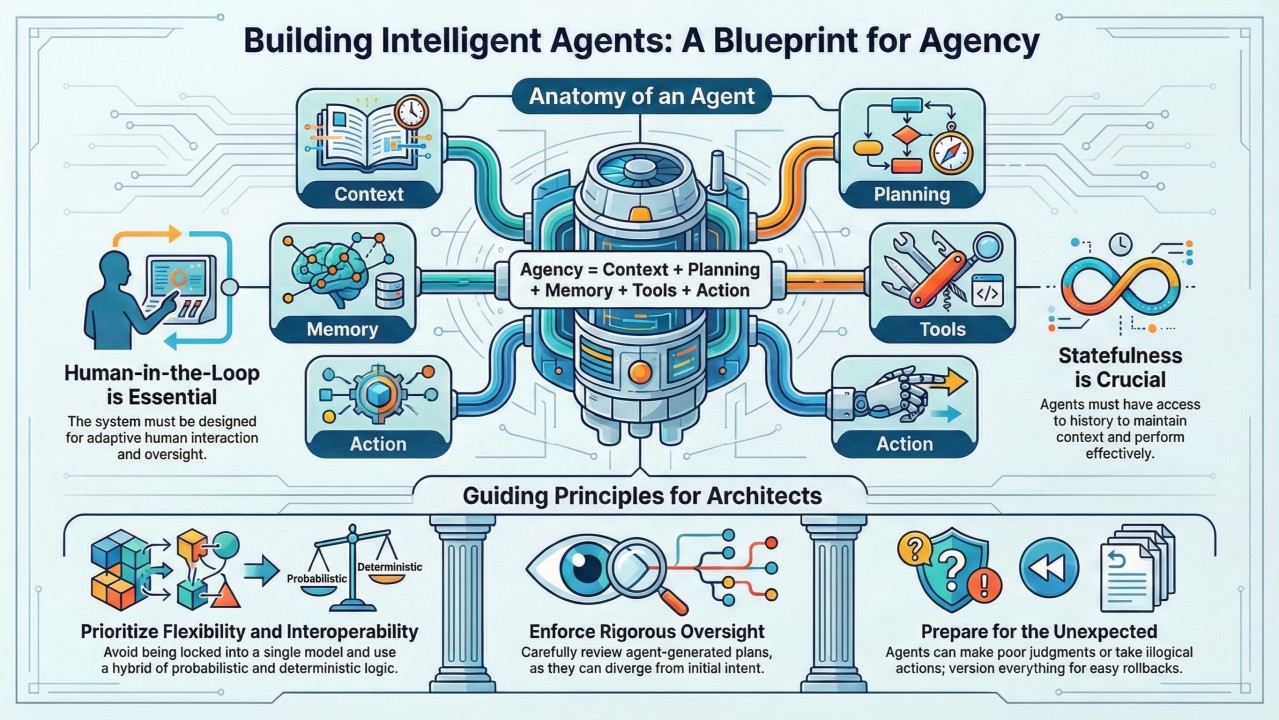

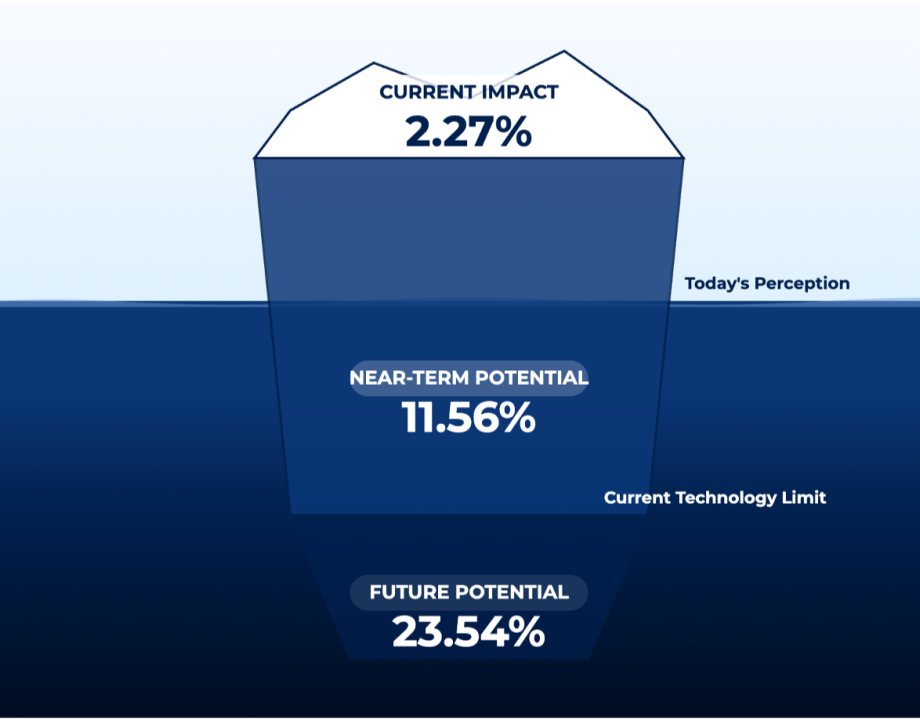

The hardest problem is not ideation or prototyping. It is the messy middle: moving from a compelling prototype to a secure, compliant, scalable production system that integrates with decades of legacy technology. Mortgage systems carry the weight of post-2008 regulation, layered applications, and fragmented workflows. AI-native solutions struggle to thread through that complexity cleanly.

Closing the messy middle is the next frontier. Progress is happening, but it will take time, partnerships, and new ways of thinking about policy, data, and integration. That is because mortgage AI today is not one thing. It is a spectrum.

On one end sits traditional or narrow AI, technologies the industry has used for years: optical character recognition, rules-based underwriting engines, document classification, machine learning models, and natural language processing for call centers. These tools quietly power much of the modern mortgage process.

Generative AI is the newer layer. It includes conversational agents, workflow orchestration, automated summarization, development acceleration, and intelligent decision support. In 2025, much of its adoption followed a familiar pattern: fear of missing out. Organizations rushed to deploy table-stakes tools simply to keep pace with competitors.

That phase is ending. In 2026, differentiation will not come from using the same copilots and summarization tools as everyone else. It will come from creative, thoughtful applications of AI that are rooted in real business understanding. It will come when organizations figure out how to unleash human creativity and weave it through the fabric of both the organization and the people within it.

The biggest opportunity to accelerate AI adoption is not technology. It is people.

Across organizations, there is a widening gap between what AI is capable of and what teams are actually doing with it. Fear plays a central role. Fear of job loss. Fear of compliance missteps. Fear of the unknown. Until those fears are addressed directly, no amount of strategy decks or vendor demos will unlock real transformation. It is the people that have to be unlocked, so that their innately human qualities can be applied in previously unimaginable ways to the most confounding problems.

Attendance is not application. Sitting through an AI presentation does not change how work gets done. It certainly does not tap into that beginner’s mindset or inspire fresh perspective. Change happens only when individuals see how AI makes their own work better, faster, and more meaningful. Organizations become 10x when their people do.

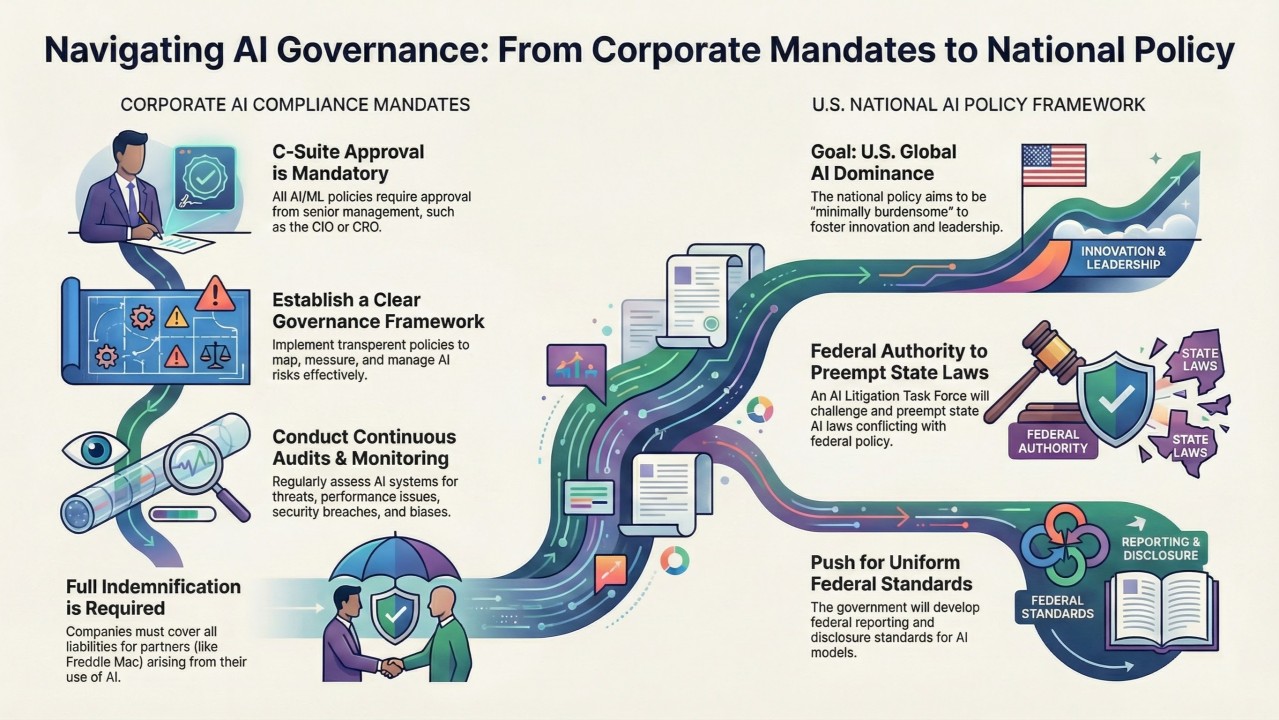

This is especially true in mortgage lending, where responsibility to borrowers, regulators, and the public is profound. There are no shortcuts. AI must be deployed responsibly, transparently, and in partnership with the humans who use it.

From a bean counting perspective, AI adds the most value today in highly repeatable, measurable tasks. These are the same tasks historically targeted for outsourcing, which raises a natural question about return on investment. The answer lies in differentiation. We count two types of beans in mortgage – heads and dollars. So long as that is what defines “value”, we will continue to look for ROI in automation when what we should really be looking at is reimagination and human spirit amplification. We don’t have beans for that.

If everyone automates the same workflows, no one gains a competitive edge. Real value comes from combining human creativity with AI capability to rethink processes entirely, not just accelerate them. The goal is not to replace judgment, but to free it.

Leaders should resist the temptation to outsource thinking to machines. First drafts, strategic ideas, and original insight still belong to humans. AI is a collaborator, not an author of vision.

For organizations wondering how to keep up without burning out, the advice is grounded and practical. First, imagine your business three years from now. Ask whether it is still relevant and what roles will look like in that future. Second, have honest conversations with people about fear, uncertainty, and opportunity. Without that, transformation stalls.

The technology is advancing faster than any organization can absorb. That is not a failure. It is a reminder that leadership, culture, and trust determine whether AI becomes a force for growth or a source of anxiety.

For the first time since the introduction of Desktop Underwriter (DU) in the 1990s, the mortgage industry has a chance to meaningfully confront its technical debt. Generative AI, deployed responsibly, offers a path to simplify complexity rather than layer on more tools. That opportunity will not realize itself automatically.

The bear is here. Whether the industry eats it or is eaten will depend less on algorithms and more on people willing to create space for beginning again.